What I Do

I know a lot of these discussions seem a little abstract, and it’s really easy to read what people say you should do, but what do they do, and does it work? So, to that end, here is what I do.

Updated in late 2020 for how my portfolio has changed. Look at file history to see what it was, and the evolution of thought.

What I'm Doing

- Most of my investments are in low-cost broad index funds. In particular I own VTSAX in a brokerage account and VIIIX in my 401k (because it's the best available option). This represents roughly 2/3rds of my market portfolio.

- I'm putting more money into VEU because I'm higher on the risk side of the efficient frontier than I need to be, so will slowly add there. I expect this to be instead of more bond allocations, slowly skewing me back towards higher risk.

- I have the remaining 1/3rd in low cost index bond funds. In particular VBTIX. I'm more heavily weighted here than I have been in the past because I'm less tolerant of volatility as I get closer to retirement. I hold these entirely in retirement accounts, because dividends from bonds are taxes as ordinary income, so if I can have that in retirement accounts and equities in brokerage I can have the non-retirement accounts dividents be taxed as capital gains.

- My 401k is a traditional (i.e. pre-tax) 401k. This is change because as I've looked at my retirement plans, the chances that my post retirement tax rate will be even close to my W-2 rate is miniscule. So, I'd rather get the advantage of saving the taxes now. I go into some of the details over at Traditional vs Roth.

- I have a handful of "passive" real estate investments. I'm slowly unwinding these because I don't see the advantages vs the risk potential of loss. I have enjoyed the income showing up in my account, but still not worth it to me.

- I utilize both Backdoor Roths and Mega Backdoor Roths (worst bandname ever).

- My company 401k changed to allow me to roll all existing IRAs into my 401k to allow me to escape the pro-rata rule. (I also mistakenly rolled in post-tax dollars, which you should avoid. If you don't know what that means, this is your clue to do more research. I also discuss it over at the Solo 401k page.)

- The 401k also allows for me to do after-tax contributions that I can then roll into a Roth 401k (this is the Mega Backdoor).

- I contribute the maximum amount possible to a traditional IRA at the beginning of the year and then convert it to Roth (Backdoor Roth).

What I'm Going to Do

- I expect over the next few years I will unwind all of the real estate because I don't see that the return is better than equities, the risk is higher, the liquidity is lower and it's not as interesting to me.

What I Did

- I used to have individual stocks. I bought them nearly 20 years ago when I had the hubris to think that I could be good at picking stocks. I finally liquidated all of them, and the results are about what you would expect.

- I lost money outright on one.

- I underperformed the broader market on all but one of the remaining.

- I likely lost money due to the cost of inflation on most of them.

- I crushed the market on one of them.

So, in summary, I had random results and had some good outcomes and bad outcomes, but the decision making process was suspect at best.

Sample Results

I worked for a company from September of 2003 until May of 2006. In that time, I contributed to my 401k, entirely into index funds. (Maybe not the best ones, but we all learn). I haven’t rolled this over to something else, so it provides a great view into a single long-term investment.

What does three years of investments with only market gains, look like over nearly 20 years?

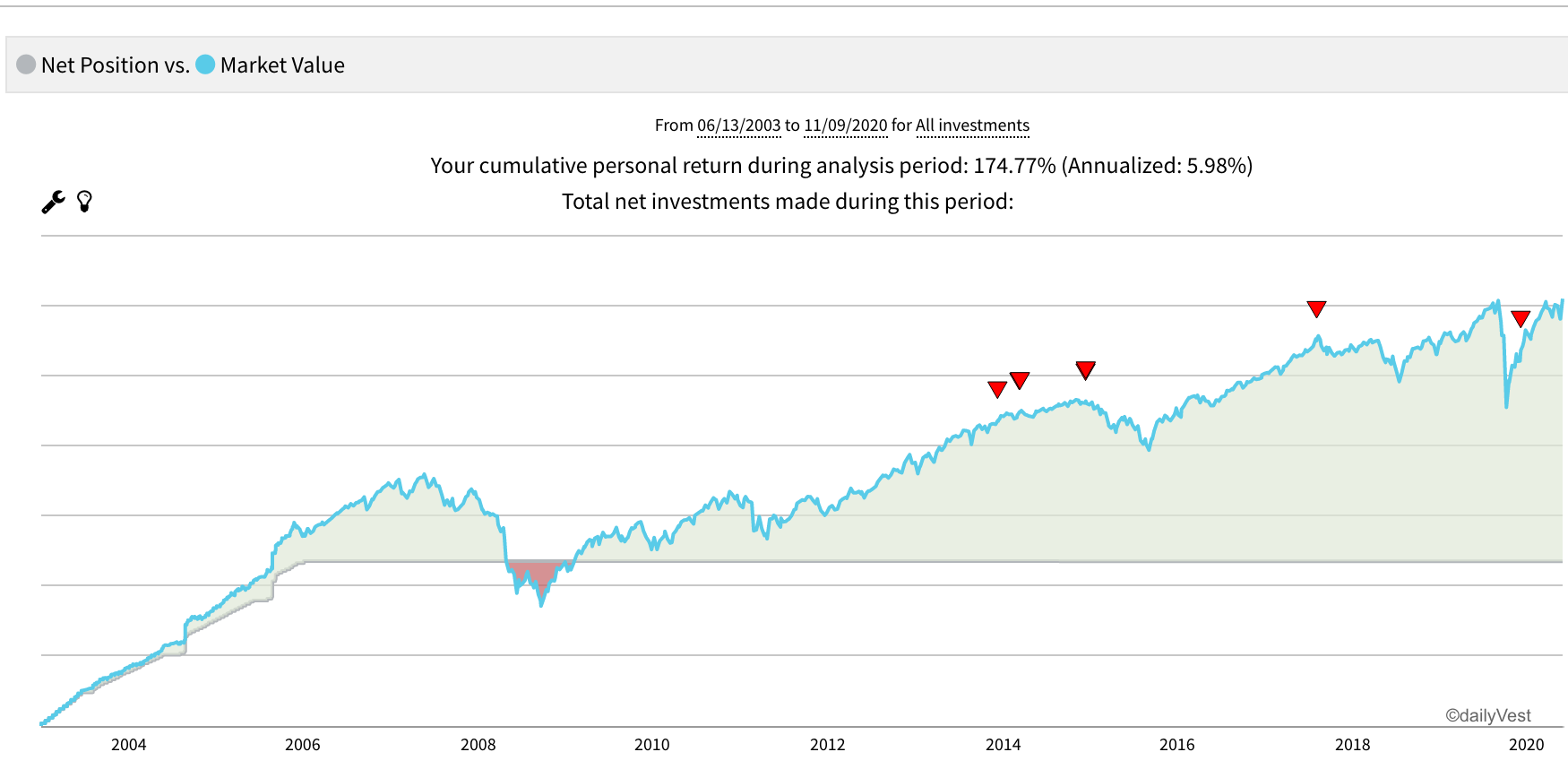

The thin grey line at the bottom is my total contributions. The blue line at the top is total value of the portfolio. The little red markers are when I made a change to allocations.

My cumulative personal return is just under 175%, which annualizes to 6%.

(The little red triangles indicate where investment changes were made. Generally, consolidating into fewer index funds.)

(The little red triangles indicate where investment changes were made. Generally, consolidating into fewer index funds.)

You’ll notice that when the Great Recession hit in 2008, the value of the portfolio was actually worth less than the amount of money I had put in. But, in less than 2 years it had recovered and it took nearly 6 years to recover to the highs of 2007, but it has continued to climb.

So, here is an actual example of how a long term buy and hold strategy for index funds works in the real world.

But how did I do compared to the S&P 500? Well, good but not great? From January of 2004 until September of 2020, S&P 500 total return was 197% with an annualized return of 6.8%. So seems like I did ok! What about with dividends reinvested? 312% and 8.9%, so maybe I didn’t do that great (S&P 500 Return Calculator, with Dividend Reinvestment, 2020). I will say, I think part of it is because I didn’t have enough low cost, index funds, something I have slowly fixed in the last few years. But, in spite of that, I have managed to at least pace the market, for this investment.