Overview

ESPP is an Employee Stock Purchase Plan. Generally speaking it provides you the opportunity to buy company stock at a discount.

If the program is setup well, you should absolutely do this. If it's not, well then, probably not. The difference is, do you get an automatic discount? If you do get an automatic discount, then this is (almost) 100% risk free return on a pretty short term.

This is the only exception I know of to the risk:reward ratio.

There may be no such thing as a free lunch, but I'm not sure how much closer this can get. You enroll and contribute (the maximum you can if you're smart) money for a 6 month period. At the end of that period you get stock at a discount (commonly 10-15%) on the lowest of the price at the beginning or end of the offering period. Mine have typically been 15%, so I'll use this number going forward. A 15% discount is actually a return of 17.6% (15/85). This means you are virtually guaranteed gross return of 17.6% every 6 months and given that it's the lowest, likely even more. Even at the highest tax rates you'll be over 10% net. There is nothing else that you can do that is this safe with a return anywhere close.

Sell! Sell! Sell!

BUT in order to be smart about this you have to sell immediately! You already have so much of your financial health tied up in the company, don't be foolish and do it here too. Take your 15% and invest it in an index or target date fund to diversify.

Now, there are people who disagree with me on this. We call them wrong. :)

Here is the logic behind that viewpoint.

"I believe in the company or I wouldn't work here. The stock has been doing great, and if I just keep the stock I can sell it later and I'll make more money!"

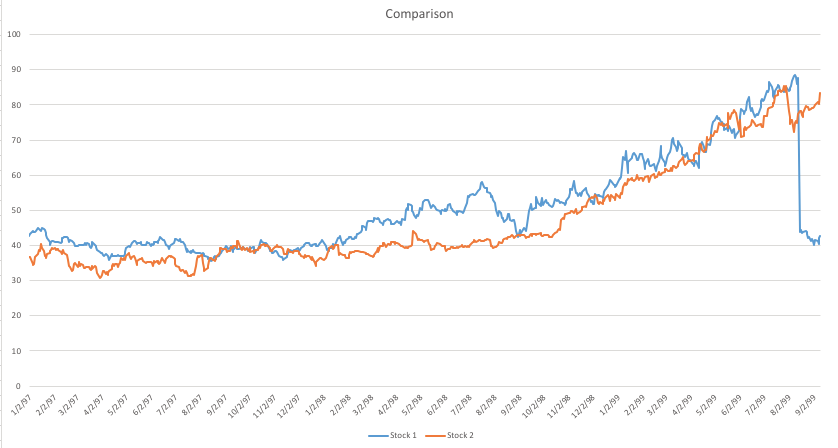

All of that is true. Heck, it might even work out better for you, but, don't confuse good outcomes with good decision making. If you have large portions of your assets in the company, and they're responsible for your salary, healthcare insurance and who knows what else, and it all goes away, you'll be financially devastated for a very long time. To illustrate my point, consider the following stock graph:

This is the stock price comparison, over the space of several years of two different companies. One is a large on-line financial services company that you could make an educated guess on. Still doing well. Stock has continued to climb, with happy employees.

The other is Enron. That blue line continued all the way to 0.

You'll notice, that for years, as an employee, you would have no way to distinguish one from the other.

"When Enron filed for bankruptcy in 1999, more than $1 billion in employee retirement savings evaporated into thin air. More recently, Lehman Brothers employees shared a similar fate," according to a Fidelity article.

Brokerages

I don't know how all of them do it. So, I'll just try to provide information as I collect it.

- ETRADE has an option to do a "Quicksale" that will auto-sell for you.

Details

Offering period

In general the offering period is this period of time that determines your purchase price. The rules behind it tend to be complex and differ by company, so it isn't generally worth it to worry about it. As long as you're getting the percentage of the lower of the beginning of the offering period and the current time, you're good to go.

Purchasing cycle

Most of the programs I've experienced are every 6 months. You have to enroll initially, but normally you're auto-enrolled in all subsequent periods. Depending on the percentage you select that money will be taken from your paycheck every pay period and held. Then at the end of the 6 months that money is used to purchase stock based on the price and the amount of money that has accumulated. (e.g. The company collected $1000 and the stock is $10, but you get it at 85% of that. $1000/($10 * .85) = 117.65 shares. Normally you can't purchase fractional shares, so you would get 117 shares and the extra $6.50 rolls over to the next period.)

Risks

There are more than a few words in there that are hedging words. "Virtually risk free" and "almost". Here are the ones I'm aware of, just so you understand them and also understand why I'm comfortable with them.

- There is a window between when the stock is purchased, and when you have access to it. Let's say the purchase date is May 1st, by the time the stock gets into the account of your broker, is a couple of days, let's say that turns into May 4th. If the stock drops by more than 15% in those 3 days you could lose money.

- Your company could go bankrupt. They've been holding your money for 6 months, and suddenly they go bankrupt. You're likely not going to get the withholdings that otherwise you would have had in your pocket.

Embarassing Admission

I no longer follow my own advice. That's right, I hold on to ESPP stock. Why? Because I've gotten to the point in my investment career where company stock went from being an investment to being speculation. Because it is a small enough portion of my overall portfolio, I can take a risk on it outperforming the market or going to zero, so I'm willing to risk holding onto it for the upside potential.